As SpaceX explores direct-to-device satellite internet, a future looms where travelers could bypass local networks—a potential upheaval for a quiet but vital part of Bali’s tourism economy.

BALI – In a strategic pivot with global implications, SpaceX, through its Starlink satellite internet division, is reportedly developing plans to launch a cellular device capable of connecting directly to its orbital constellation, bypassing traditional mobile networks entirely. While details remain speculative and SpaceX founder Elon Musk has offered contradictory public statements, the exploration signals a possible future where connectivity is untethered from local ground infrastructure.

For a place like Bali—where selling temporary SIM cards and eSIMs to tourists is a ubiquitous, multi-million dollar micro-industry—this emerging technology presents a profound paradox of promise and disruption.

The Promise: An ‘Always-Connected’ Island

For Bali, a hub for digital nomads and adventure tourism, the potential upside of reliable, direct satellite connectivity is significant. It could solve the persistent challenge of coverage in remote but popular areas like the Nusa Islands, Amed, Munduk, or the slopes of Mount Batur, enhancing safety and convenience for visitors.

This would bolster Bali’s appeal as a seamless, ‘work-from-anywhere’ destination and improve resilience during natural disasters that can knock out local cell towers. In theory, it elevates the entire island’s value proposition.

The Threat to a Cornerstone Convenience

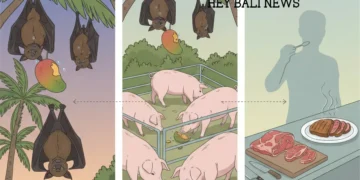

However, this future also casts a shadow over a deeply entrenched business model. From the kiosks at I Gusti Ngurah Rai Airport to online eSIM resellers, a small economy thrives on one simple need: tourists require local data to stay online. As reported by Reuters, if SpaceX or similar ventures succeed in making direct-to-device satellite connectivity affordable and mainstream, the foundational need for a local SIM or tourist eSIM evaporates.

Why navigate a foreign telco’s plans when your own device has global, orbital coverage?

This wouldn’t just pressure prices; it could render a whole layer of retail and resale activity obsolete. The generic “best coverage” eSIM package loses its appeal against a satellite link offering global roaming without SIM swaps. The most vulnerable players are those whose sole value is providing basic data access: airport booth vendors and resellers without added services.

A Nuanced Future: Coexistence, Not Immediate Extinction

Industry observers caution that this shift won’t be instantaneous. As Musk himself noted, such a device would be “very different from current phones” and likely optimized for advanced computing. Regulatory hurdles in Indonesia and high initial costs mean that, for at least 3-5 years, satellite connectivity will remain a premium option. The existing ecosystem will have time to adapt.

The likely survivors and thrivers in this new landscape will be those offering bundled value beyond mere data: local phone numbers for services like Gojek or WhatsApp, integrated customer support, or hybrid packages that combine cellular, Wi-Fi, and satellite backup. Hospitality venues may also benefit by offering seamless, high-tier connectivity as a premium service.

For Bali’s tourism stakeholders, the Starlink report is less an imminent threat and more a crucial strategic signal. It underscores that the island’s digital infrastructure—and the businesses built upon it—must evolve from selling basic access to providing integrated, experience-enhancing services. The era where a SIM card was a tourist’s first purchase upon arrival may eventually sunset, replaced by a world where the connection comes from the sky, challenging Bali to find new ways to add value on the ground.